BRI (BBRI) continues to be committed to presenting the latest products that are safe, comfortable, and innovative and continues to provide the best service for its customers.

One of them is realized through the signing of a Memorandum of Understanding (MoU) between BRI and PT Kliring Berjangka Indonesia (PT KBI) in order to introduce a futures exchange transaction system through BRI.

In this collaboration, BRI acts as a Margin Fund Depository Bank (BPDM) while PT KBI plays a role in providing the best service for guaranteeing the settlement of futures contract transactions, warehouse receipts, commodity physical markets, and integrated commodity information services.

The signing of this cooperation took place at the Innovation Center of BRI Building Jakarta on Wednesday (22/02/2024) which was attended directly by BRI's Director of Retail Funding and Distribution, Andrijanto, and KBI President Director, Budi Susanto.

Andrijanto said, this cooperation is a breakthrough that marks BRI's move towards innovation in conducting futures exchange transactions that are easy, convenient, and innovative to its customers.

The existence of BRI as BPDM has functions, among others, as a depository for margin funds, where the funds are used as collateral or margin to conduct transactions. BRI's existence as BPDM also complies with applicable rules and regulations related to the management of margin funds, including minimum capital requirements and investor protection.

“This cooperation is not only an important momentum for BRI and PT KBI, but also shows BRI's dedication to providing the best service to its customers. By becoming a Margin Fund Depository Bank (BPDM), the cooperation between BRI and PT KBI is a manifestation of BRI's presence to facilitate all transactions, especially futures exchange transactions, “said Andrijanto, in his official statement, Wednesday (5/22/2024).

Andrijanto added, BRI has become an important pillar in the banking sector in Indonesia, dedicated to increasing financial inclusion and providing innovative banking solutions to its diverse customers.

With a rich heritage and commitment to excellence, BRI continues to be a pioneer in the financial industry whose services can be enjoyed by all levels of society.

Meanwhile, Budi Susanto said that with this collaboration, the commodity futures trading ecosystem is complete and will certainly provide more transaction service options for the public.

“As a clearing house, we are responsible for ensuring that every transaction runs in accordance with applicable regulations,” said Budi.

During 2023, PT KBI has conducted futures contracts and other derivatives totaling 7,830,098 lots excluding single stock contract transactions amounting to 218,853 lots.

Meanwhile, the daily transaction volume including CFDs or recorded at 30,115.8 lots. Meanwhile, the daily average volume outside CFD or Single Stock is 29,293.2 lots.

With the presence of BRI as BPDM, it is hoped that it can further create alternative opportunities for third party funds for BRI and can strengthen the commodity futures trading industry which is more reliable, transparent and competitive at the national and global levels.

BRI and PT KBI have a commitment to always present the latest products that are certainly safe, comfortable and innovative. With the cooperation that will take place, both parties hope to be able to answer challenges better, and provide the right solutions for customers.

“This cooperation is a clear proof of our commitment in strengthening the commodity futures trading ecosystem in Indonesia. We believe that with BRI's support as a Margin Fund Depository Bank, more and more people will be able to experience the ease and security of transactions. This is an important step to ensure that the commodity futures trading industry in Indonesia is increasingly trusted and competitive at the national and global levels,” said Budi.

PT Kliring Berjangka Indonesia (PT KBI) is establishing itself as part of the country's economic growth agent

PT Kliring Berjangka Indonesia (PT KBI) has started a new step in implementing the CSR program

PT Kliring Berjangka Indonesia (PT KBI) has held an inauguration for their new office at Menara Danareksa

Asset Auction

Asset Auction

Langkah Strategis PT KBI dan Bank BJB untuk perkuat Sistem Resi Gudang Indonesia

KBI Achieve the "Best Corporate in Establishing The AKHLAK Implementation Index" Award at the 2024 BUMN Awards

KBI Ramadan Media Gathering Moving into Action for Better

KBI participated in organizing Mudik Asyik Bersama BUMN in 2024

PT KBI and JFX held a Halal Bihalal event with futures trading industry

Universitas Airlangga FTLC Program with PT Valbury, JFX and KBI

PT Kliring Berjangka Indonesia Achieves idAA Stable Outlook Rating On Operational Performance in 2023

PT KBI Wins Gold Award in Economic Pillar Category at TJSL & CSR Award 2024

PT KBI wins the 5th Anniversary Indonesia Popular Reputation Awards 2024

Supporting the government's Food Security program, PT KBI and PT JIEP developed a Warehouse Receipt System.

PT KBI supports PBK Literacy Month, focusing on digital transformation and strengthening synergy in the commodity future

PT KBI and PT KIMA collaborate to develop industrial area warehouse as a strategic step to strengthen the company

PT KBI strengthens Indonesia's food security by developing a Commodity Trading Ecosystem through synergy and system tran

Collaboration between PT KBI, PT KPBI, and Bank Jatim Develops Warehouse Receipt

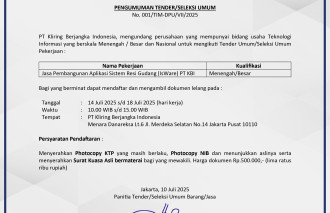

PT Kliring Berjangka Indonesia Mengadakan Tender Umum

PT KBI Holds KBI 5th ESport Championship Again

KBI's Role in Futures Trading Ecosystem

PT KBI Collaborates with Bank INA as BPDM

PT KBI Partners with Bank BJB to Strengthen Commodity Trading Ecosystem

PT KBI is Optimist to Strengthen Physical Digital Gold Trading in 2025

PT KBI Strengthens National Food Security Program Through Optimization of Rice Barns in Jombang, East Java

PT KBI wins prestigious award for Best Public Relations in the Financial Services category

PT KBI once again received a prestigious award in digital innovation at the 6th Indonesia Top Digital Innovation Award

In the spirit of the holy month of Ramadan, PT KBI encourages spreading kindness through Ramadan Bergerak campaign

KBI recorded a surge in strategic commodity transaction volumes amid geopolitical and economic uncertainty.

Global economic uncertainty caused by geopolitical tensions and trade wars has led to a shift in investment to gold, whi

It is not just about cultivating commodities, but this issue has deep links to issues of sustainability

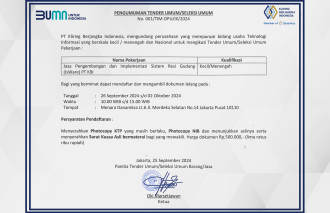

Pengumuman Tender Umum/Seleksi Umum Untuk Perusahaan IT

A country with vast agribusiness and logistics potential, Indonesia requires a transparent & reliable warehouse system

Bank Muamalat collaborates with KBI in the use of banking services for transaction settlement

PT KBI as the only Warehouse Receipt Registration Center in Indonesia

PT KBI Received the 50 Popular PR Person Award of 2025 at The Iconomics event

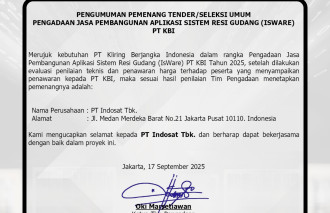

Pengumuman pemenang tender umum pengadaan jasa pembangunan aplikasi sistem resi gudang (ISWARE) PT KBI

The Golden Generation with CFTC Skills: Understand Risks and Opportunities

Scholarship program for undergraduate students

Realizing Industrial Estate Warehouse Integration and Warehouse Receipt

Strengthening Governance and Competitiveness of Commodity Trade

Warehouse Receipt Ecosystem Synergy at Trade Expo Indonesia 2025

JFX and KBI Synergy in Commodity Trading Mining

PT KBI Promotes Auction of 20 Tons of Coffee Runs Successfully

KBI Expands Role until US Stock Exchanges

PT KPBI is granted liscense as Warehouse Manager by BAPPEBTI

PT KBI Strengthens Priority Social and Environmental Responsibility (TJSL) Programs

KBI Strengthens Warehouse Receipt Ecosystem

PT KBI Makes History: The Only State-Owned Enterprise Appointed by Bank Indonesia as a PUVA Clearing Institution

From Village to Stock Exchange: Time to Democratize Capital