The reciprocal import tariff policy announced by US President Donald Trump's administration in early April has triggered significant turmoil in global commodity markets, especially in strategic commodities such as gold. As a clearing house for futures trading, PT Kliring Berjangka Indonesia (PT KBI) recorded a surge in strategic commodity transaction volumes amid geopolitical and economic uncertainty.

The US import tariff policy of 32% for Indonesia and up to more than 100% for certain products from China has disrupted global supply chains, prompting investors to turn to safe-haven assets such as gold and physical commodities. The following is the latest data observed in the Indonesian market during Q1 2025:

The overall London Loco Gold Transaction Volume on the Jakarta Futures Exchange (JFX) increased 20.2% yoy to total 1,491,864 lots (Q1 2025) compared to 1,240,323 lots (Q1 2024).

The driving factor for the data is the uncertainty of the Rupiah exchange rate against the USD as well as hedging demand from industry players. Currently, Indonesia is facing the unique challenge of a “Currency-Commodity Double Squeeze,” where rising Gold Prices are triggered by global safe-haven demand and a Strengthening USD against the Rupiah. This combination increases inflationary pressure and import costs in various industrial sectors.

In response, as reported by Bloomberg Technoz, Bank Indonesia (BI) has activated a "Triple Intervention Instrument" to maintain Rupiah stability: Intervention in the forex market, Adjustment of benchmark interest rates, and Optimization of foreign exchange reserves. In line with this, as a clearing house, PT KBI implements a real-time monitoring system to ensure futures market operations using Intra-Day Margin, where margins are calculated based on the last price at JFX and clearing members are encouraged to top-up margins in the event of a shortage.

Budi Susanto, President Director of PT KBI, emphasized: "We have anticipated this turmoil by strengthening operational monitoring of margin fulfillment in real time using Intra Day Margin every 2 (two) hours. In Futures Trading, the price fluctuations that are currently occurring are a good opportunity that can be utilized by industry players. The direct impact of these price fluctuations is an increase in Loco London gold transactions, this also reflects investor confidence in safe-haven instruments amid market uncertainty. PT KBI in this case will continue to be committed to supporting financial system stability through a transparent, responsive and reliable clearing mechanism."

LOCO LONDON CONTRACT TRANSACTION VOLUME TABLE DATA [PERIOD 1 JAN - 31 MAR 2024 versus 2025]

|

Commodity |

Q1 2024 Transaction Volume |

Q1 2025 Transaction Volume |

YoY |

|

XUL10 |

1,021,446.3 lot |

1,088,087.1 lot |

[+6.5%] |

|

XUL14 |

168,400.9 lot |

267,922.7 lot |

[+59%] |

|

XUL12 |

26,674.2 lot |

55,283.6 lot |

[+107%] |

|

XULF |

23,801.5 lot |

80,570.9 lot |

[+238%] |

PT KBI continues to coordinate with relevant authorities, including the Commodity Futures Trading Supervisory Agency (BAPPEBTI), Bank Indonesia (BI), and the Financial Services Authority (OJK) to mitigate systemic risk in the Futures Market. This effort is in line with the BUMN mission to encourage inclusive and globally competitive economic growth in Indonesia.

PT Kliring Berjangka Indonesia (PT KBI) is establishing itself as part of the country's economic growth agent

PT Kliring Berjangka Indonesia (PT KBI) has started a new step in implementing the CSR program

PT Kliring Berjangka Indonesia (PT KBI) has held an inauguration for their new office at Menara Danareksa

Asset Auction

Asset Auction

Langkah Strategis PT KBI dan Bank BJB untuk perkuat Sistem Resi Gudang Indonesia

KBI Achieve the "Best Corporate in Establishing The AKHLAK Implementation Index" Award at the 2024 BUMN Awards

KBI Ramadan Media Gathering Moving into Action for Better

KBI participated in organizing Mudik Asyik Bersama BUMN in 2024

PT KBI and JFX held a Halal Bihalal event with futures trading industry

Universitas Airlangga FTLC Program with PT Valbury, JFX and KBI

KBI Cooperates with BRI (BBRI) as Margin Fund Depository Bank

PT Kliring Berjangka Indonesia Achieves idAA Stable Outlook Rating On Operational Performance in 2023

PT KBI Wins Gold Award in Economic Pillar Category at TJSL & CSR Award 2024

PT KBI wins the 5th Anniversary Indonesia Popular Reputation Awards 2024

Supporting the government's Food Security program, PT KBI and PT JIEP developed a Warehouse Receipt System.

PT KBI supports PBK Literacy Month, focusing on digital transformation and strengthening synergy in the commodity future

PT KBI and PT KIMA collaborate to develop industrial area warehouse as a strategic step to strengthen the company

PT KBI strengthens Indonesia's food security by developing a Commodity Trading Ecosystem through synergy and system tran

Collaboration between PT KBI, PT KPBI, and Bank Jatim Develops Warehouse Receipt

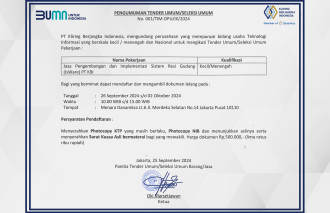

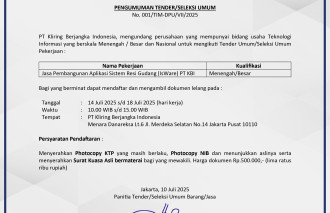

PT Kliring Berjangka Indonesia Mengadakan Tender Umum

PT KBI Holds KBI 5th ESport Championship Again

KBI's Role in Futures Trading Ecosystem

PT KBI Collaborates with Bank INA as BPDM

PT KBI Partners with Bank BJB to Strengthen Commodity Trading Ecosystem

PT KBI is Optimist to Strengthen Physical Digital Gold Trading in 2025

PT KBI Strengthens National Food Security Program Through Optimization of Rice Barns in Jombang, East Java

PT KBI wins prestigious award for Best Public Relations in the Financial Services category

PT KBI once again received a prestigious award in digital innovation at the 6th Indonesia Top Digital Innovation Award

In the spirit of the holy month of Ramadan, PT KBI encourages spreading kindness through Ramadan Bergerak campaign

Global economic uncertainty caused by geopolitical tensions and trade wars has led to a shift in investment to gold, whi

It is not just about cultivating commodities, but this issue has deep links to issues of sustainability

Pengumuman Tender Umum/Seleksi Umum Untuk Perusahaan IT

A country with vast agribusiness and logistics potential, Indonesia requires a transparent & reliable warehouse system

Bank Muamalat collaborates with KBI in the use of banking services for transaction settlement

PT KBI as the only Warehouse Receipt Registration Center in Indonesia

PT KBI Received the 50 Popular PR Person Award of 2025 at The Iconomics event

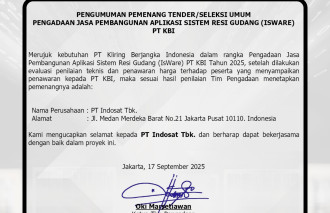

Pengumuman pemenang tender umum pengadaan jasa pembangunan aplikasi sistem resi gudang (ISWARE) PT KBI

The Golden Generation with CFTC Skills: Understand Risks and Opportunities

Scholarship program for undergraduate students

Realizing Industrial Estate Warehouse Integration and Warehouse Receipt

Strengthening Governance and Competitiveness of Commodity Trade

Warehouse Receipt Ecosystem Synergy at Trade Expo Indonesia 2025

JFX and KBI Synergy in Commodity Trading Mining

PT KBI Promotes Auction of 20 Tons of Coffee Runs Successfully

KBI Expands Role until US Stock Exchanges

PT KPBI is granted liscense as Warehouse Manager by BAPPEBTI

PT KBI Strengthens Priority Social and Environmental Responsibility (TJSL) Programs

KBI Strengthens Warehouse Receipt Ecosystem

PT KBI Makes History: The Only State-Owned Enterprise Appointed by Bank Indonesia as a PUVA Clearing Institution

From Village to Stock Exchange: Time to Democratize Capital